Gold has been a cornerstone of wealth and stability for centuries. Among the various forms of gold investment, bullion bars stand out as a preferred choice for many investors. This article explores the advantages, characteristics, and considerations of investing in bullion bars, highlighting why they are a reliable asset for wealth preservation and growth.

Understanding Bullion Bars

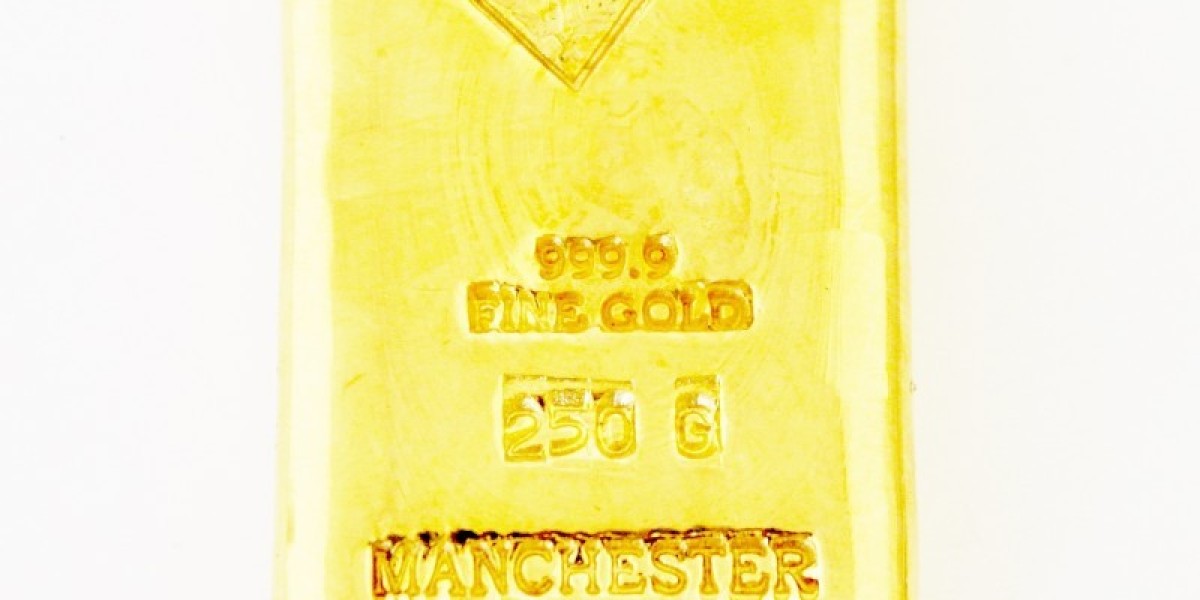

Bullion bars are rectangular pieces of precious metals, primarily gold, silver, platinum, or palladium, that are produced by recognized mints and refineries. They come in various sizes and weights, ranging from as small as 1 gram to as large as 1 kilogram or more. Gold bullion bars are typically made from high-purity gold, often 99.99% pure (24 karats), ensuring that investors receive a high-quality product.

Benefits of Investing in Bullion Bars

Wealth Preservation: Bullion bars are an excellent tool for preserving wealth. Unlike paper currency, which can depreciate due to inflation, bullion bars retain their intrinsic value over time. This makes them a reliable hedge against economic instability and currency devaluation.

Tangibility and Security: Bullion bars are tangible assets that you can hold, providing a sense of security and ownership. This tangibility is a significant advantage over digital or paper investments, which can be more volatile and less predictable.

Liquidity: Bullion bars are highly liquid and can be easily bought and sold in global markets. Their standardized weights and purities make them universally recognized and accepted, facilitating quick transactions.

Diverse Portfolio: Adding bullion bars to an investment portfolio helps diversify assets, reducing overall risk. Precious metals often perform well during economic downturns, providing a counterbalance to other investments like stocks or bonds.

Flexibility in Investment: Bullion bars come in various sizes and weights, offering flexibility for investors with different budgets. Smaller bars, such as 1g or 10g, allow for incremental investment, while larger bars, such as 1kg, provide a significant store of value.

Considerations When Buying Bullion Bars

Reputable Dealers: Purchase bullion bars from reputable dealers or mints to ensure authenticity and quality. Look for dealers with positive reviews, industry certifications, and a proven track record.

Purity and Certification: Ensure that the bullion bars come with bullion bars certificates of authenticity and purity. These certificates should detail the weight, purity (often 99.99%), and the bar’s unique serial number.

Premiums and Costs: Understand the premiums associated with buying bullion bars. These premiums cover production, distribution, and dealer margins. Comparing premiums from different dealers can help you get the best value for your investment.

Storage and Security: Choose a secure storage option for your bullion bars. Options include home safes, bank deposit boxes, and professional vault services. Ensure that your storage choice is secure and offers insurance for your precious metals.

Market Awareness: Gold and other precious metals prices fluctuate based on economic conditions, geopolitical events, and market demand. Stay informed about market trends and consider timing your purchase to maximize returns.

Steps to Purchase Bullion Bars

Research: Start by researching reputable gold dealers or mints. Check reviews, certifications, and industry standing to ensure reliability.

Verify Purity and Weight: Ensure the bullion bars have a high purity (at least 99.99% for gold) and verify the weight. Look for certification from recognized authorities.

Compare Premiums: Compare the premiums over the spot price of gold or other precious metals from different dealers to ensure you get the best deal.

Choose Storage: Decide on a secure storage option for your bullion bars. Options include home safes, bank deposit boxes, and professional vault services.

Monitor the Market: Stay informed about the gold and precious metals markets and economic conditions to make well-timed purchases and sales.

Conclusion

Investing in bullion bars is a prudent strategy for preserving and growing wealth. With their intrinsic value, high liquidity, and role as a hedge against economic instability, bullion bars offer a secure and tangible means of investment. Whether you are a new investor or an experienced one, bullion bars provide a reliable and versatile option for achieving long-term financial security.